All international trade changes—to tariffs, taxes, trade agreements and deals—affect ecommerce companies selling products to consumers in other countries, and bringing components, parts, and manufactured goods to the US. International shipping is complex and nuanced, to do it successfully, it’s important to understand all current trade agreements, customs and trade regulations, plus import and export guidelines all around the world.

What is USMCA?

Originally signed at the G20 Summit in November 2018, USMCA stands for United States, Mexico, Canada Trade Agreement. It officially went into effect July 1, 2020, replacing the North American Free Trade Agreement (NAFTA).

The goal of USMCA is to create a more free trade environment between the US, Canada, and Mexico, by lowering the barriers of import and export. Depending on which country you ask, there are many pros and cons to the regulations.

In the eyes of the US, the biggest changes made initially under USMCA give more attention to the regulation of steel products and automotive products. Companies selling large and high value goods (like cars) are affected in more regions and more aspects of their supply chain. Though the USMCA agreement affects some shipments more than others, the highest impacts of the changes from NAFTA include:

- increased de minimis threshold in Canada and Mexico

- different form requirements for the Certification of Origin, including the new Origin Criterion requirement

- updated Rules of Origin principles that encourage more local manufacturing and US sourcing

USMCA Increased the De Minimis Value Threshold

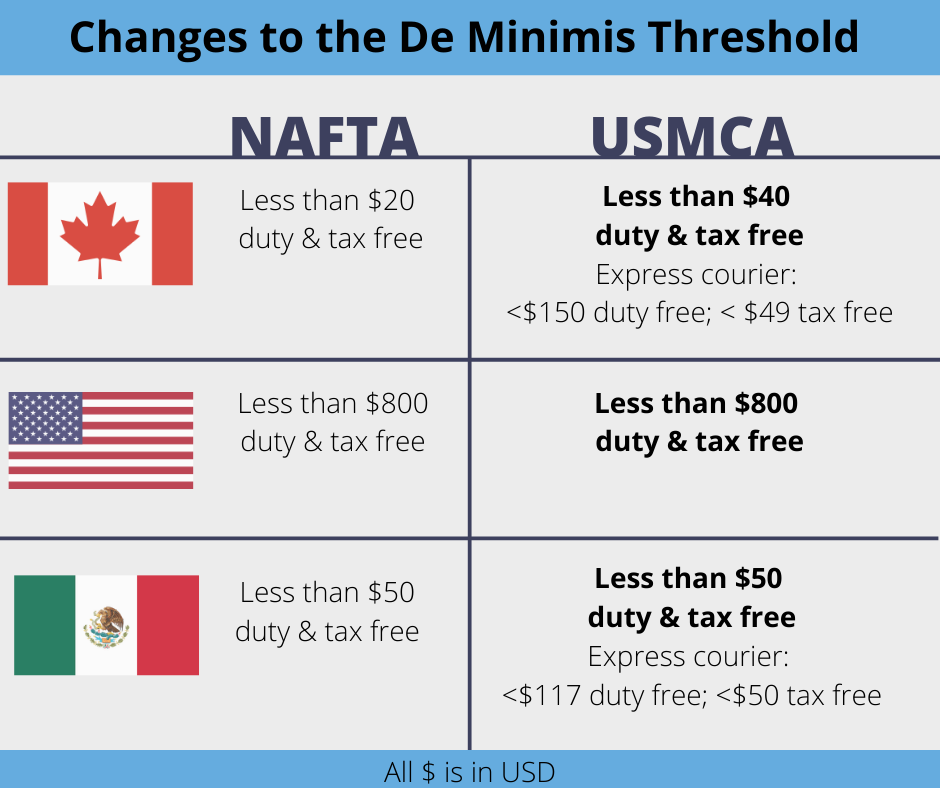

One of the main changes when USMCA went into effect was an increase in de minimis value. This is a duty and tax placed on goods imported into any country that are above a certain value. In large part the increased de minimis value is a reaction to the rapid growth of ecommerce.

Under USMCA the Canadian de minimis was increased from $20 to $40 (retail value). That means any item that is over $40 USD going into Canada is subject to import tax. Mexico’s de minimis is $150 USD, and in the US the value threshold is one of the highest in the world, $800 for any goods being imported in. Many countries have very different thresholds, but the disparity between the US and Canada is stark.

The caveat to this change is that the Canadian de minimis has only changed for certain carrier options. The $40 threshold into Canada is only for goods that are transported via express courier—that means carriers like Fedex, UPS, etc. If it goes in via the postal mail they are still subject to the old threshold of $20.

There were no changes to the US de minimis threshold under USMCA. In 2016, under NAFTA the threshold was changed from $200 to $800, and it remains $800 now under USMCA.

Be sure your goods are allowed into Canada before you begin importing. Here is a list of restricted and prohibited goods when shipping into Canada.

The Impact: Smooth Customs and Cost Competitive Advantage

By increasing the de minimis threshold for importing into Canada and Mexico, US ecommerce sellers have a few advantages over what they did with NAFTA.

The current change in Canada’s value threshold has allowed US companies, specifically small and medium sized companies to participate more freely in cross-border trade into Canada. Essentially companies selling low-cost goods will be better able to compete in the Canadian market because they can bring in goods under a $40 value without paying taxes. Sellers shipping to Canada can bring products in much more cost effectively and compete within the Canadian market.

For goods under the de minimis threshold, this also reduces compliance costs and complexity at customs. Importers will now have less operational duties to move products into Canada, including the elimination of opening a foreign office as a condition for doing business for companies who meet the requirements.

Other benefits include less probability of products being held at the border, less probability of extra fees or delays for incorrect documentation, and more available capital to invest in other aspects of their business.

USMCA New Requirements for Certification of Origin

Under NAFTA the exporter was required to include a specific certificate which is now no longer required under USMCA.

When you bring goods into a country, a few basic things are required: a commercial invoice, a packing list, and all shipping documentation which includes the bill of lading and other forms. The Certification of Origin is a part of that documentation, it’s basically a signed, dated form from the importer that ensures the products have been evaluated and they meet all regulations. The new required Certificate of Origin information includes nine specific elements:

- Certifier Information

- Blanket Period/ Single Shipment

- Importer Information

- HS Code and Goods Description

- Certification Signature and Date

- Origin Criterion (new)

- Exporter Information

- Producer Information

- Indicate Certifier

Claims for preferential treatment (meaning low duty or no duty) must contain all nine elements. Without a specific form for this anymore, the way that companies include these nine elements can happen in two different ways:

- Include the nine required elements on the commercial invoice (most of the information might already be there, but likely needs restructuring to ensure they are clear)

- Include a separate certification form that is in compliance with these nine elements—technically any document is acceptable provided it sufficiently describes the goods and doesn’t interfere with swift and proper identification by customs

Imact: Streamlined Customs Forms

What may seem like a small administrative shift can really add up in terms of time and cost. If you are already shipping into other countries, it can be quite an effort to fully reformat your forms to ensure you comply with the new regulations.

For smaller companies the hassle to reformat may seem like too much, so continuing what you’ve been doing might seem easier in the short term. But it might add up on operational costs and time in the long term. It is likely worth the effort and the extra cost to create a standardized Certificate of Origin form. This will streamline your paperwork and ensure consistency and compliance through customs morning forward.

“Clients engage us to help them navigate the complexities of international transportation and trade. We provide end-to-end guidance to eliminate the guesswork and ambiguity often experienced with global shipping. This permits them to focus on their core business activities as they expand to foreign markets with confidence. Informed compliance and risk mitigation proves critical to keep our clients volumes moving, and we strive to exceed performance targets and minimize throughput costs while ensuring compliance to US and foreign export and import regulations.”

For smaller companies who are sourcing locally or producing products in the US a new reformatted Certificate of Origin will be helpful to them, specifically concerning the Origin Criterion that is a new element within the nine.

USMCA New Rules of Origin Support US Economic Growth

The Rules of Origin are a set of principles that determine preferential treatment (or not) of the tariff and tax of certain goods or products. These are set by the countries involved in the agreement in order to increase product sourcing and labor to their respective countries.

The industry that is affected the most under USMCA is automotive. Others like chemicals, pharmaceuticals, and many others are impacted by these changes. The update encourages more US manufacturing therefore economic growth here in the States; in order to meet this new regulation companies are going to have to source more in the US and produce more in the US.

IMPACT: More Companies Will Source US Products

The benefit of these changes will be felt by the US as a whole. The changes under USMCA are in the favor of the US to drive growth of manufacturing and local product sourcing. Remember, this trade agreement touches many industries, so agricultural products, factories, and any manufacturing facilities are all included in these requirements.

For more than 40 or 50 years US industries have been focused on outsourcing and manufacturing outside of the US. The USMCA is a bold new step to try to bring it back, focusing on creating more jobs in the US and sourcing locally, and it’s working. In the last few years many companies have changed their upstream supply chain drastically and brought the raw material manufacturing back to the US.

At DCL we have a seasoned staff of experts who can help your small business navigate new regulations as they are ratified, passed, and enforced. Within the USMCA agreement and we can help you assess your products to see exactly what the impact would be.

DCL’s fulfillment and logistics experience is much broader than just pick, pack, ship. We offer robust transportation and trade help to our clients. Contact us today if you want support with your international shipping strategy.

Tags: International