The US and China agreed to a 90-day pause on some tariffs, cutting reciprocal tariffs from 125% to 10%. However, most other tariffs — including Section 301 (7.5%–25%), IEEPA (20%), and HTS-based duties (0–40%) — still apply. A 20% fentanyl-related tariff and steel/aluminum tariffs under Section 232 also remain unchanged. The Section 321 de minimis exemption is still eliminated, meaning all shipments from China, even under $800, face duties. Despite the rollback, the effective tariff rate on Chinese goods remains high at around 39%, and freight demand is expected to surge.

Section 321 Suspended for China-Imported Godds, Effective May 2, 2025

Since early February 2025, President Trump has made many changes to import/export regulations, including tariffs on imports from Canada, Mexico, EU, Vietnam, and more, and the highest tariffs on imports from China.

Additionally his suspension of the Section 321 customs de minimis entry process, meaning shipments valued under $800 (such as e-commerce retail shipments) will no longer be duty-free and will now be subject to tariffs—for China-imported goods, effective May 2, 2025; for Canada- and Mexico-imported goods, effective date TBD.

Understanding De Minimis: A Simplified Guide to Import Fees for International Ecommerce Brands

Preparing your products to ship internationally is a complex process. Calculating international shipping fees alone requires a detailed strategy and in-depth understanding of product classification, customs fees and current international trade agreements.

There’s one factor that may slip between the cracks for some ecommerce brands—the ‘de minimis’ value. De minimis is a concept that tends to baffle many, especially those new to international shipping. But it’s a critical component of customs fees. Understanding de minimis is essential for ecommerce brands, as it directly impacts the final cost your customer pays.

By being aware of the de minimis thresholds in each market where you ship goods, you can better predict and manage any additional costs—thus providing your customers a more transparent and efficient delivery experience.

What is De Minimis?

De minimis refers to a threshold value set by different countries, when goods are below that value threshold they can be imported with no duties or taxes levied. If the value of the goods being shipped is under the de minimis threshold of the country you’re importing to, then your package won’t incur any tax or duty fees. It’s like a customs-free pass for low-value shipments.

Here is an example. Country A has a de minimis value of $400. If you ship a product priced less than $400 to country A, the import fee is waived. The recipient doesn’t have to pay any extra charges. More expensive packages, on the other hand, can accrue duty or tax charges.

How to Determine the De Minimis Value?

The de minimis value is country-specific and varies from one nation to another. Some countries, like the United States, have a high de minimis threshold, while countries like Canada and the European Union have a lower de minimis value.

Determining the de minimis value can be a daunting task due to its international nature, but it’s crucial. A miscalculation could cause customs trouble, delay your shipments, and result in unexpected costs to you or the end consumer.

The information regarding the current de minimis values is usually available via the customs or commerce department of the concerned country, or through your shipping carrier. Staying informed helps you adequately price your products and provide accurate and transparent shipping prices to your international customers.

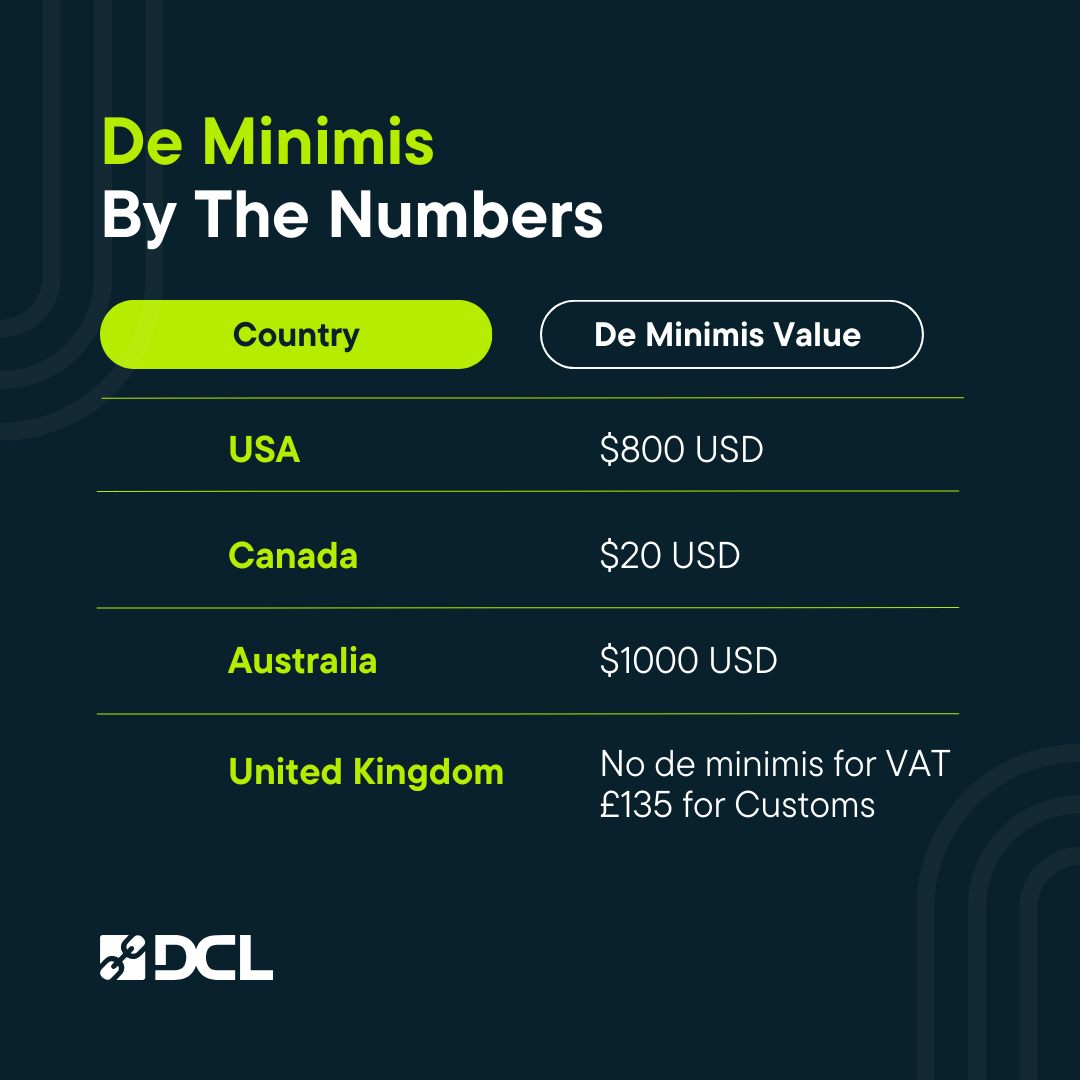

De Minimis by the Numbers

To help you gain a clear view of the de minimis landscape, here’s a quick reference table of some popular ecommerce markets:

Keep in mind that these values could change, according to the countries’ economic decisions. Therefore, it’s essential to regularly check with a reliable source, like your shipping carrier or a customs advisor.

Why De Minimis Values Vary

Puzzled as to why each country has a different de minimis threshold? It’s all tied to a nation’s specific trade policy, economic conditions, or simply a decision to stimulate certain transactions or industries.

Some countries have a high threshold to promote inbound trade, while others keep it low to protect local industries. Therefore, as an ecommerce brand, it’s crucial to stay updated on these international shipping nuances.

Key Factors That Determine De Minimis Thresholds

When it comes to international shipping for your ecommerce business, understanding the factors that determine de minimis thresholds is undoubtedly crucial. These values are not randomly assigned and actually rely on several key elements. The variability of de minimis thresholds across different countries can significantly affect your import costs and, subsequently, the final price of your goods.

The Country's Customs Regulations

Each country has its own rules and regulations regarding importation, which distinctly influence the de minimis thresholds. Some countries have a high threshold to encourage foreign trade and facilitate smoother transactions, while others maintain a low value to protect local industries or collect import duties.

The Type of Goods Imported

The de minimis value can also be dependent on the type of goods. For example, import of certain items like alcohol, tobacco, or items which a country deems sensitive, may have a lower or no de minimis value applicable. On the other hand, goods classified as personal effects or low-value items typically enjoy higher thresholds.

Trade Agreements

Countries part of major trade agreements often have similar or matching de minimis thresholds. These agreements aim to simplify trade between member nations, creating a uniform environment for ecommerce businesses.

Government Policies

Policy is often what determines the de minimis threshold. For instance, in times of economic uncertainty, a country may decide to lower its de minimis value to safeguard local businesses and boost domestic revenues through increased import duties.

The Impact of De Minimis on Ecommerce

The relationship between de minimis thresholds and your ecommerce brand is in the costs you—and consequently, your customers—bear. If the de minimis value is high, your customers in that country enjoy reduced costs. If it’s low, they might have to pay import fees, which can make your product less attractive compared to local alternatives.

Not accounting for de minimis values can cause unpleasant surprises for your customers—like getting hit with unexpected customs charges. This can affect customer satisfaction and, therefore, your brand reputation.

For a thriving international ecommerce business, it’s vital that you factor de minimis values into your shipping strategy. It will help you be more transparent in your pricing and maintain customer trust.

Bottom Line

De minimis isn’t a fixed or arbitrary value but a carefully calibrated number influenced by a multitude of factors both economic and political. It’s crucial for ecommerce brands to understand these variables to strategically navigate international shipping costs and regulations.

If you are unclear about what your customs fees will be, it’s important to work with an international shipping expert.

This post was written by Maureen Walsh, Marketing Manager at DCL Logistics. A writer and blogging specialist for over 15 years, she helps create quality resources for ecommerce brands looking to optimize their business.

Tags: International