The Difference Between Duties, Taxes, and Tariffs—How They Factor Into Your International Shipping Strategy

By Munish Gupta, Founder and CEO of Supply Chain Advisory Group

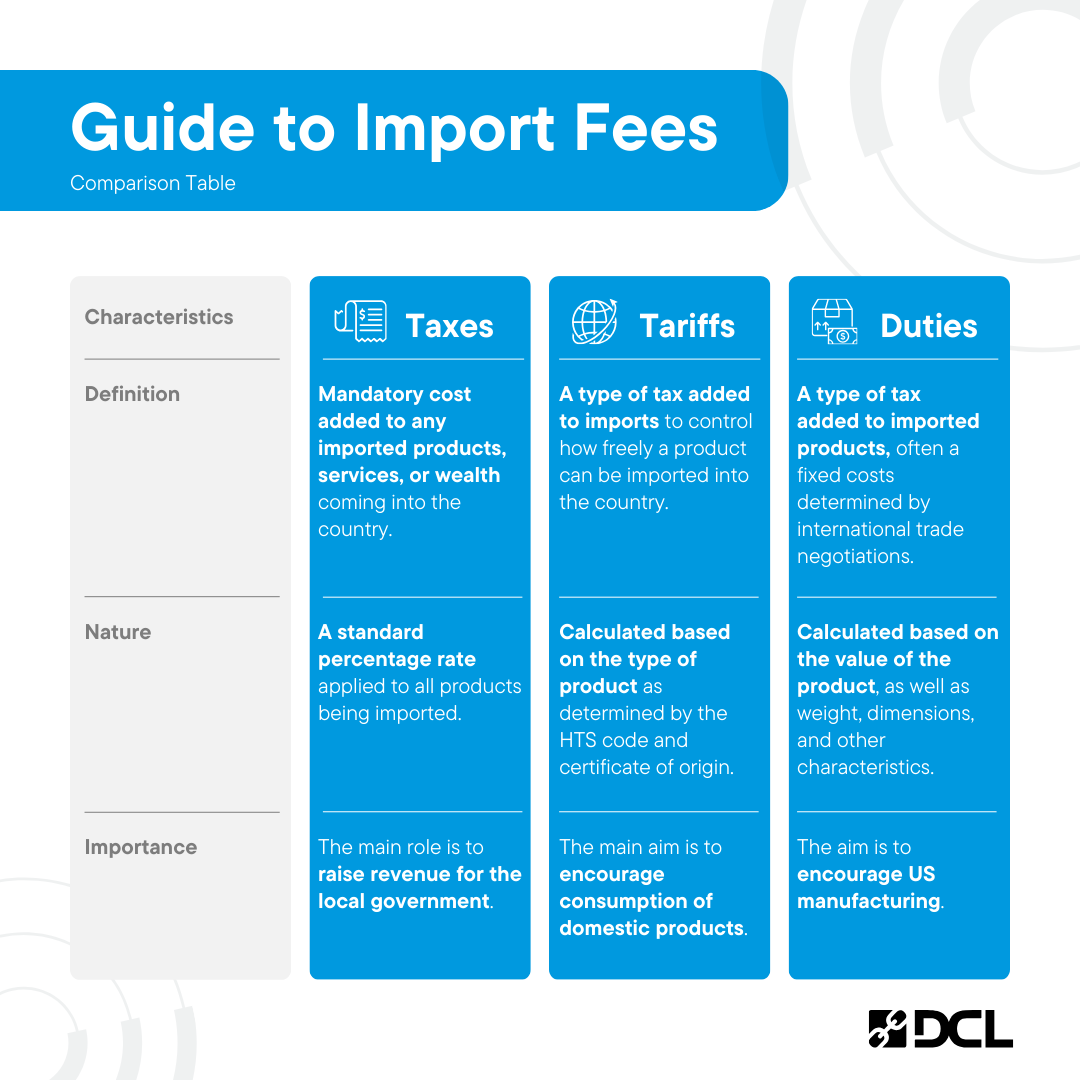

Import fees are important to consider when executing an international shipping strategy. While often used interchangeably, it’s important to note the distinct differences between taxes, tariffs, and duties.

In general, customs duties are based on product characteristics, tariffs are fees applied to specific products from specific countries for specific times, and tax rates (VAT/GST) are fixed and calculated on the total value of the product imported into the country. Every country has different fee obligations, with different rates, rules, and forms. It’s important to work with trusted international partners to ensure you are in compliance, and that you don’t have any surprise fees coming your way after you import your products.

What are Customs Duties?

Anytime you import a product into a country, you’ll incur duty fees. These are fixed by the government to determine how freely a product can be let into the country. For example, if the US has a lot of steel already being manufactured here, the government may put a 100% duty on steel being imported from other countries. It’s an attempt to stop other countries sending too much product that’s already made here; duties can help boost US manufacturing which in turn promotes US jobs, products, resources and more.

For most consumer goods (consumer electronics, apparel, etc) duty fees are usually 5-7% of the import value, because these products may not have as big of an impact on the economy. Duty rates are applied to certain categories of materials and products, and they largely depend on how much that country needs them.

There will always be duties, they change but they won’t ever go away. Duties are often determined by international trade negotiations. They vary from 0% to 30-40% of the import value of the product. For example, a leather handbag might have only a 5% import duty in the United States but it might have a 30% import duty in Japan. Duties change but not very quickly, because they are based on negotiations between countries. Staying updated on the latest foreign relations will help sellers understand where their products may have fluctuating duty rates, or not.

How to Calculate Duties for Customs Compliance

Customs compliance involves paying correct duties on each product’s 10 digit HTS code. This is a fixed code that is dependent on the characteristics of your product. Every type of product is classified with a specific HTS code. Your freight forwarder or customs broker will be able to find your HTS code and calculate your duty rates from there.

Companies are strongly encouraged to not deliberately undervalue products, or misdeclare one type of item as another in order to avoid paying a higher duty rate. As an example, if you sell a leather handbag and declare it as that, it will be assigned a specific HTS code. But if your handbag is actually 60% leather and 40% cotton, you need to ensure that your HTS code is correct given all facets of your product. This is where an expert will be the best help to figure it out. If you misdeclare your goods, there is a very high chance that customs will find this out sooner or later and you will be subject to very heavy penalties and fines.

Certificate of Origin Can Change Your Duty Rates

Imported products must be declared as originating in a particular country. A certificate of origin is an important declaration for customs, and in some cases the country named can change what a seller pays in customs duties.

For example, a product might be manufactured 40% in China, and 60% manufactured and assembled in Vietnam. If the seller declares a certificate or origin that it’s made in Vietnam from Chinese components, they won’t have to pay the (current) extra 25% Trump tariff on Chinese imported goods.

Depending on the trade climate and how distributed your manufacturing network is, a certificate of origin that declares your products from a certain country, will change your overall duty rates. You may end up paying higher or lower duties than if you declared a different certificate of origin.

Learn how to reclaim duties and taxes on international returns.

Defining the Most Optimal Incoterms

If an overseas manufacturer makes a product and then sells them to your company, the Incoterms define how the relationship works between the buyer and the seller (in this case your company and the manufacturer, respectively). Incoterms are a widely-used set of 11 distinct, internationally recognized rules that define the responsibilities of both the seller and buyer of any given product. They specify who is responsible for the shipment, insurance, documentation, customs clearance, and other logistics. Sellers must factor these costs into their shipping.

Choosing Incoterms can have a big difference in overall cost as well as the relationship with your manufacturer. For example, if a seller chooses the Incoterm Ex Works (EXW), when they buy the product from their manufacturer at the dock (ready to take it back to the US for distribution and fulfillment) the seller is responsible for paying the freight, the cargo insurance, and the clearing customs in the US. On the opposite end of the spectrum, if a seller chooses the Incoterm DDP (Under the Delivered Duty Paid), the manufacturer can just send the product to a warehouse in the US, and it’s understood that the manufacturer will take care of everything (shipping, cargo, customs, etc). The drawback to DDP is that the manufacturer will likely take a premium because they are taking care of these logistics and fees for you.

All of your Incoterms will inform the customs clearance and who manages the duties. It’s important to work with a reputable freight forwarder to help define the right Incoterms based on your specific products, the countries you are working with, and the current trade climate.

What are Tariffs?

Often confused with duties, tariffs are fees imposed by a government for certain products, or categories of products, at distinct times. Right now, for example, between US, Canada, and Mexico the current USMCA trade agreement states that there are no tariffs. But with China there is a blanket 25% tariff (on top of any duties) given to any products imported into the US. Just like duties, the percentage increase of a tariff is calculated from the import value of the product, and very often the fees are passed on to the end-customer. Tariffs can drastically change the prices of imported goods, thus affecting consumer habits.

Tariffs can also change quickly. They are determined by the whim of the US government, based on how that government wants to impose restrictions from certain foreign countries. Experts believe a Biden government will unravel much of what Trump instituted within three to six months. There is still uncertainty on how the US/Chinese relations will play out.

Import Taxes, Explained

Import taxes are based on the standard percentage, defined by the government, of additional cost added to any imported product coming into the country. Based on the country it may be called Value-Added Tax (VAT) or Goods and Services Tax (GST). VAT and GST are very similar in terms of their implementation, but each is applied to different products based on the country importing into.

For example, The UK has a VAT rate of 20% and Australia has a GST rate of 10%. All VAT/GST are a flat percentage rate applied to all products being imported. The US is one of the few countries that does not have VAT or GST which leads to a lot of US companies assuming that other countries are the same. This assumption can lead to costly implications.

It’s important to note that Canada also has a provincial tax (PST) that varies between the different Canadian states. There is also a harmonized state tax (HST) when importing there. If you’re shipping into Canada, it’s best to understand the differences between PST, HST, and GST to make sure you’re not overpaying on customs fees.

One aspect of importing goods that relates to taxes is the importer of record (IOR). This is the entity which holds responsibility for all customs documentation, product classifications, and payments of duties and taxes. The importer of record is required to have an established VAT number in order to function properly in this role. For most companies shipping internationally out of the US, the biggest market is Europe so you need to be properly set up for VAT. If you are going to be using a warehouse in Europe you need to designate an IOR and set up a VAT number.

Sellers must clarify with customers upfront who is responsible for the VAT/GST—you can use the landed cost solution or let the customer pay these taxes. For example, if a customer in the UK assumes that the shipping includes the 20% VAT and you had not figured that into your final product cost, then you will all of a sudden have a 20% hit on your profit margins.

Factoring Import Costs into Your Shipping Strategy

Companies have two options in how they fold import fees into their overall shipping strategy. One way is to deliver the product to the customer where all the duties, taxes, and shipping are paid upfront and the customer just receives the product at the doorstep. This is called the total landed cost solution and leads to a smooth customer experience.

Total landed cost is calculated by taking every factor into account. These are things such as the order value, shipping costs, cargo insurance costs, and all duties and taxes. These fees are all folded into the final amount the customer pays upfront. With this, there are no surprise fees or goods withheld at customs.

The other option is to let the end-customer pay for import duties and taxes. When this happens, the customer will get a note from the post office saying that they have to come to the post office to pay the taxes and duties and then get the product released. This can lead to a bad customer experience. It is important that companies decide the shipping strategy upfront and convey that to customers before they purchase.

How to Find Experts to Help

There are two distinct components of shipping, domestic and international. For domestic shipping, it’s best to work with a reputable 3PL who can calculate the best carrier service for your products getting from the port, to the warehouse, to your end-customer.

International shipping, on the other hand, includes air freight, cargo insurance, and all the duties and taxes. For these, working with a trusted freight forwarder to calculate and optimize them will be the best method to ensure all international fees are folded into your shipping strategy.

You can work with an import freight forwarder who will help with services: customs brokerage and freight forwarding. They will help you determine the best freight option (air or ocean) and then also manages all of the customs clearance work. Any certified customs broker will be licensed by the government so their services will be standardized. But when you are looking for freight services and optimizing those based on your company and product, it might make sense to talk with a few providers. Freight has more nuance and variation, and companies who outsource those for sellers are largely private companies whose services and fees will vary. If you work with a 3PL, they should have good recommendations on international partners who are trusted and have a good reputation. A consulting agency like Supply Chain Advisory Group is a great resource to help optimize your costs, especially to figure out correct VAT/GST compliance.

Munish Gupta is Founder and CEO of Supply Chain Advisory Group. He has managed supply chain operations at Infineon Technologies and Overstock.com. His experience spans worldwide manufacturing operations, warehousing/fulfillment operations, global logistics/transportation and inventory management.

If you’re looking for a 3PL with fulfillment centers in cities across the US, we own and operate facilities in The Bay Area, Los Angeles, Kentucky, and the East Coast.

Be sure to review the list of services we offer, including ecommerce fulfillment, retail fulfillment, Amazon fulfillment services, reverse logistics, transportation management, and kitting & assembly.

Tags: International