International ecommerce shippers must navigate a range of customs regulations when shipping goods across borders. One critical aspect of clearing customs is determining whether a shipment requires a formal entry (Entry Type 01) or an informal entry (Entry Type 86).

Understanding the distinction between these two types of customs entry is essential ensuring compliance, avoiding unnecessary costs, and ensuring timely delivery of shipments.

What is a Formal Entry?

Formal entry is required for shipments that exceed a country’s designated value threshold or contain regulated commodities. It involves a more detailed customs clearance process, requiring additional documentation, and, in many cases, the assistance of a licensed customs broker.

Key Characteristics of Formal Entry:

- Higher Value Threshold: In the United States, for example, shipments valued at over $2,500 USD generally require a formal entry.

- Detailed Documentation: Formal entries require submission of a commercial invoice, packing list, bill of lading or airway bill, and potentially other import-related documents.

- Customs Bond Requirement: A customs bond is often required to ensure compliance with customs regulations and payment of duties.

- Brokerage Fees: Due to the complexity of formal entries, importers typically use a licensed customs broker to facilitate the process.

- Longer Processing Time: Because customs authorities need to review and process more documentation, formal entries can take longer to clear than informal entries.

- Compliance with Regulations: Some controlled goods, such as food, medical devices, pharmaceuticals, and electronics, may always require formal entry, regardless of their value.

What is an Informal Entry?

An informal entry is a streamlined customs clearance process for shipments that fall under a specified value threshold and do not contain regulated or restricted items. Informal entries require less paperwork, making them a preferred option for many e-commerce retailers and small importers.

Key Characteristics of Informal Entry:

- Lower Value Threshold: In the US, shipments valued under $2,500 USD typically qualify for informal entry. Other countries have their own thresholds.

- Simplified Documentation: Fewer documents are required compared to formal entries, often limited to a commercial invoice and airway bill.

- No Customs Bond Required: Unlike formal entries, informal entries do not require a customs bond, reducing the cost for importers.

- Faster Clearance: Informal entries are usually processed quickly, helping businesses expedite shipments to customers.

- Exclusions for Certain Goods: Some products, even if they fall under the value threshold, may still require formal entry due to regulatory concerns (e.g., alcohol, tobacco, firearms, and pharmaceuticals).

Choosing Between Formal and Informal Entry

For international ecommerce businesses, selecting the right type of entry depends on factors such as shipment value, product type, and destination country regulations. Here are some considerations to keep in mind:

1. Shipment Value

If your shipment is valued under the country’s informal entry threshold, you may opt for an informal entry.

If your shipment exceeds the threshold, you must prepare for a formal entry, which may require additional documentation and brokerage services.

2. Product Category

Regulated products may require formal entry, regardless of their value.

Non-restricted consumer goods such as clothing, books, and household items often qualify for informal entry.

3. Speed vs. Compliance

If quick delivery is a priority, ensuring shipments qualify for informal entry can reduce customs processing time.

If dealing with high-value or regulated goods, businesses should prepare for the formal entry process and associated costs.

Entry Type 86 vs. Entry Type 01: What Shippers Need to Know

There are many different entry types to choose from when importing goods into the US. Having your products cleared with US Customs and Border Protection (CBP), international ecommerce shippers must understand the key distinctions between Entry Type 86 and Entry Type 01.

Each type has its own requirements, limitations, and compliance responsibilities.

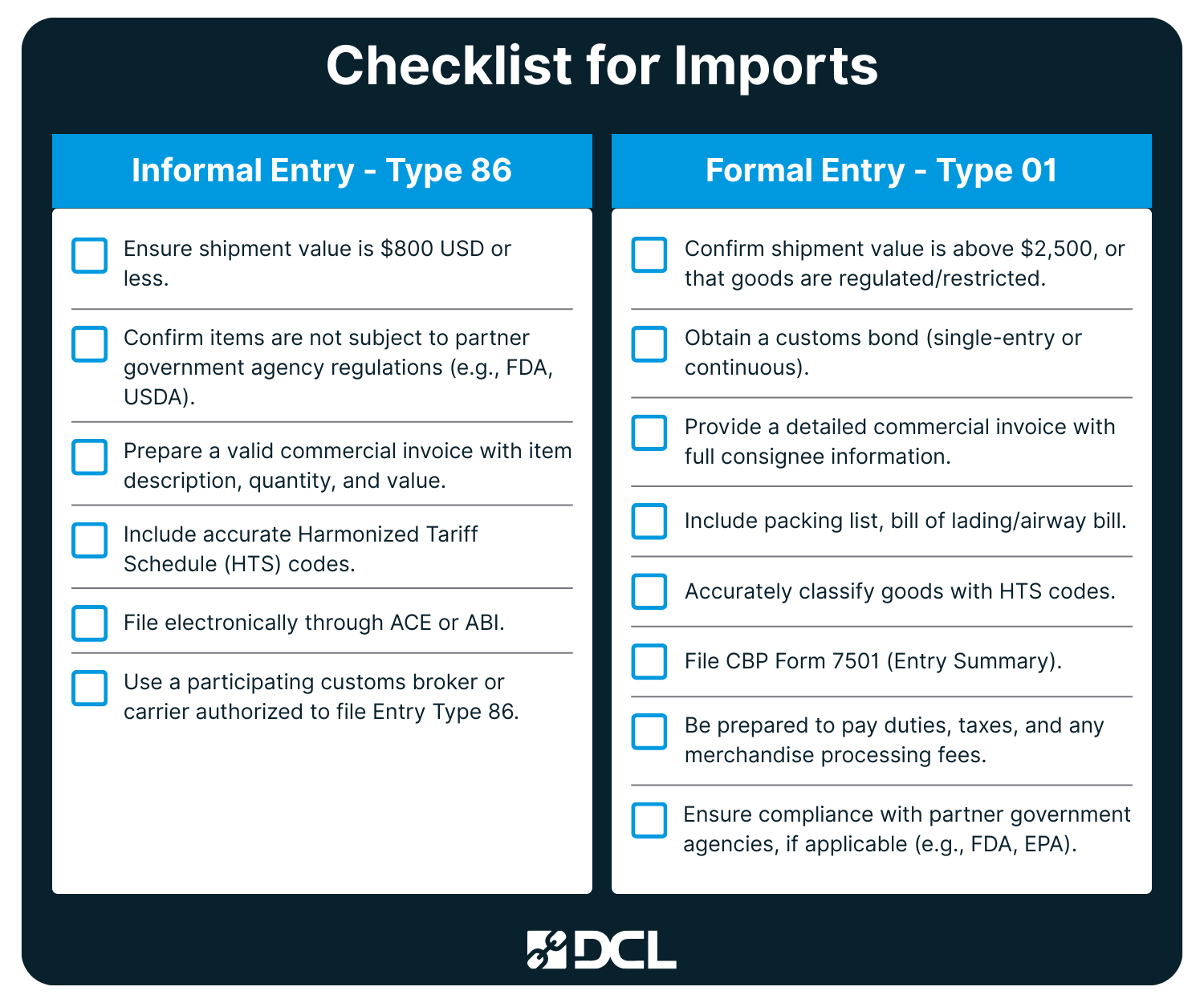

Shipper’s Checklist: Entry Type 86 vs. Entry Type 01

For Entry Type 86:

- Ensure shipment value is $800 USD or less.

- Confirm items are not subject to partner government agency regulations (e.g., FDA, USDA).

- Prepare a valid commercial invoice with item description, quantity, and value.

- Include accurate Harmonized Tariff Schedule (HTS) codes.

- File electronically through ACE or ABI.

- Use a participating customs broker or carrier authorized to file Entry Type 86.

For Entry Type 01 (Formal Entry):

- Confirm shipment value is above $2,500, or that goods are regulated/restricted.

- Obtain a customs bond (single-entry or continuous).

- Provide a detailed commercial invoice with full consignee information.

- Include packing list, bill of lading/airway bill.

- Accurately classify goods with HTS codes.

- File CBP Form 7501 (Entry Summary).

- Be prepared to pay duties, taxes, and any merchandise processing fees.

- Ensure compliance with partner government agencies, if applicable (e.g., FDA, EPA).

Understanding the difference between Entry Type 86 and Entry Type 01 is crucial for avoiding delays, fines, or denied entry. Choosing the correct type based on shipment value and content ensures compliance and smooth delivery for your international ecommerce operations.

How the Customs Entry Process Works for Ecommerce Importers?

When importing or exporting products, all items must pass through many check points at the border. US Customs and Border Protection (CBP) reviews shipment documentation, including invoices, HS codes, and manifests, to determine whether a shipment qualifies for formal or informal entry. They may also conduct physical inspections, assess duty and tax compliance, and verify adherence to import regulations based on the shipment’s value and commodity type.

Ecommerce brands need to ensure the importing process is smooth to limit delays in their supply chain. International trade can be complex, but having correct all entry summaries, CBP forms, and customs documentation clear and correct will help eliminate any pitfalls or issues.

Best Practices for Ecommerce Shippers

To streamline customs clearance and avoid delays, e-commerce sellers should adopt the following best practices:

- Understand Destination Country Regulations: Research the value thresholds and product restrictions for each country where you ship.

- Use Accurate HS Codes: Assign the correct Harmonized System (HS) code to products to prevent misclassification and potential penalties.

- Ensure Proper Documentation: Even for informal entries, including clear and complete invoices and shipping details can prevent unnecessary customs holds.

- Consider Working with a Customs Broker: For shipments that require formal entry, partnering with a broker can simplify the process and prevent compliance issues.

- Monitor Duty and Tax Implications: Be aware of potential duty rates and tax responsibilities to manage costs effectively.

- Communicate Clearly with Customers: Inform customers about possible customs delays and duties they may need to pay upon delivery.

Bottom Line

For international ecommerce businesses, understanding the difference between formal and informal entry is crucial to ensuring smooth customs clearance and efficient delivery. While informal entry is a faster and simpler process for lower-value shipments, formal entry is necessary for higher-value or regulated goods.

By staying informed and implementing best practices, ecommerce shippers can optimize their logistics strategy, minimize customs delays, and enhance customer satisfaction.

This post was written by Maureen Walsh, Marketing Manager at DCL Logistics. A writer and blogging specialist for over 15 years, she helps create quality resources for ecommerce brands looking to optimize their business.

Tags: International