When deciding to start shipping internationally, there are so many decisions to make. One of the biggest is how to resolve customs fees—who pays for them and when they get paid.

For sellers new to international markets it might be difficult to understand how to sort out which is right for them.

What’s the Difference Between DDU and DDP?

When shipping internationally all shippers need to use the internationally recognized system of Incoterms, which are shipping terms noted in many international shipping documents to clarify the roles and responsibilities of both buyer and seller of any goods imported and exported. DDU and DDP are both incoterms that specifically note who pays for customs fees of products that pass through customs clearance.

- DDU (Delivered Duty Unpaid): The customer only pays for shipping at checkout. Any additional duties, taxes, or customs fees are paid once the package arrives at customs. Customers are expected to submit payment to the local post office where they pick up the package before the package is released from customs. Because of this, DDU often keeps shipments held up at customs. DDU shipping is more likely chosen for low value goods as duties don’t kick in until the value of the goods exceeds a certain threshold which vary by country but are typically low.

- DDP (Delivered Duty Paid): The customer pays for shipping and any duties, taxes, or customs fees at checkout. Costs may seem higher because they are all upfront. Paying before the shipment gets through customs ensures there are no hold ups or delayed packages. DDP shipping is increasingly in favor for many ecommerce sellers around the world.

Neither is cheaper or more cost-effective across the board, the biggest difference between paying all fees upfront or paying shipping and customs fees separately. The nuances of choosing between these should consider current international trade agreements, product types, customs charges, customer needs, and your company’s business model.

What Happens at Customs

Have you ever had a package you’ve purchased get stuck at customs? It’s not something everyone has personally dealt with, and it’s good for sellers to understand what it’s like for a consumer to have to go and pick it up at a specified location.

International shipments must pass through a few customs procedures before being released—export clearance happens at the origin country and import clearance happens at the destination country. If your documentation is incomplete or unclear your products will be held up at any one of these stops:

- Origin country scans. Before getting on a boat or plane, a shipment leaving the US will need to pass through US customs. An agent will check to ensure you’re not shipping any contraband.

- Commercial Invoice. To get through US customs smoothly, it’s imperative that the listed contents on your documentation clearly match what’s being exported. Agents will also use the information on your commercial invoice to relay any specifics to the destination country (like tax liability).

- Travel. After your shipment passes through US customs, it will board a plane or ship and be transported to it’s next stop.

- Destination country scans. Your shipment will go through a very similar process in the foreign customs office as it did when it left the origin country. Make sure your documentation for the destination country is correct—every country has different rules and regulations.

- Duties and tax determination. After checking your shipment meets all of the import country’s regulations, a customs agent will determine the customs fees that are due.

- Additional needs. Every country has specific rules that sellers need to know before shipping there; Canada, for example, requires US sellers to set up a non-resident importer (NRI) and provide a specific Canadian commercial invoice (CCI).

Key Differences: How to Choose DDP v DDU

Either option is acceptable as long as you communicate clearly with your customers exactly what they should expect: will they need to pick their package up at customs? Are there extra fees they’ll be responsible for after the checkout process? You want to give your customers the smoothest experience possible, so making it clear what they are responsible for is the best case scenario when choosing between DDP and DDU.

Is DDP More Expensive?

Because DDP is all costs paid upfront, it appears to be more expensive in the checkout process. For some customers this might deter them from completing the checkout process; this is especially so if their total cart balance is lower than the shipping and customs fees.

Sellers can choose to pay for some or all of the duties and taxes to help encourage the buyer to buy from them. For low cost items, the difference between $10 and $50 for overall shipping and customs is significant. The actual customs fees total will vary depending on the product and agreements between the origin country and destination country.

Does DDU Lower Cart Abandonment?

DDU might seem like a better option if you want cart conversions. Having a lower cost at checkout might cycle more customers through the purchase process. The drawback is if those customers have any subsequent issues. Customers aren’t going to come back to make more purchases if their package gets stuck at customs, or they have to go pick it up. Plus they’ll likely lose interest in your brand if they end up with surprise fees.

More About Incoterms

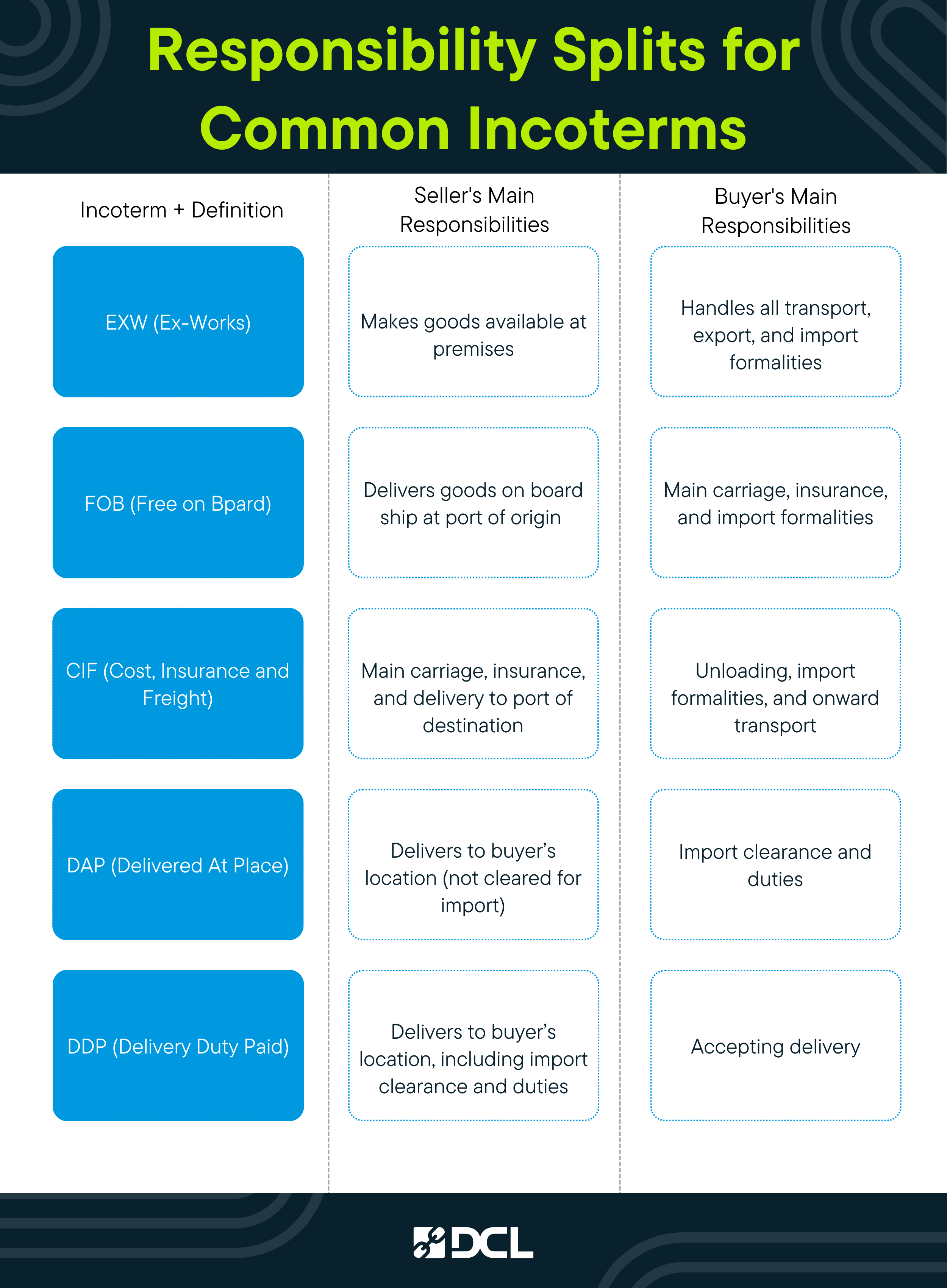

It’s worth noting here that DDU and DDP are only two of eleven Incoterms. All incoterms are internationally recognized standards that define roles of both the buyer and seller. Incoterms help determine who is responsible for paying import taxes, transportation costs, and more. Below are some how the seller’s responsibility and buyer’s responsibility can be split between some common Incoterms.

Benefits of Working with International Shipping Experts

There are many variables to consider when choosing DDU versus DDP. It’s best to work with international shipping experts who can help get you set up for a smooth customs experience. What to look for with an international shipping parter:

- Turnkey DDP Solution. No more held packages or surprise fees; sellers can charge and collect duty and tax fees at checkout to deliver a seamless delivery experience.

- End-to-end Tracking. Sellers have access to a branded tracking page with accurate delivery dates, precise pickup locations, and direct integration with last mile carriers.

- High-touch Customer Support. Handling the day-to-day international shipping questions and support to maximize a smooth customs experience, leaving you to focus on growing your global brand.

- One Simple Rate. Best in class parcel shipping, DDP calculator, customer support, and international customs expertise are all included in one flat rate.

- Compliance Solutions. UK and EU VAT compliance service, having your international provider as the merchant of record for ongoing compliance. Fully integrated HS code compliance. Regulatory compliance navigation for food, cosmetics, supplements, and other sensitive industries.

If you’re looking to get into new markets abroad, reach out for a quote. Together with Passport we’d love to support your international business. Our teams will help make the process smooth for you and a great experience for your customers.

Tags: International