Update – July 30 2025: The US government has officially ended the de minimis exemption (also known as Section 321) for all countries, meaning low-value imports under $800 will now be subject to duties and customs scrutiny. Read how it’s impacting ecommerce brands.

EU <> US trade deal is done. 15% tariffs on EU made goods and essentially 0% on US made goods. The China 30% tariffs received a 90-day extension (10% Baseline + 20% + section 301 stays in place for a least another 90 days).

On February 1, 2025, President Trump signed an executive action that included a clause to suspend the Section 321 customs de minimis entry process (originally effective February 4,2025, currently delayed), which previously allowed shipments under $800 to enter the US duty-free. See below for the current policies, as they have been delayed or amended many times since.

By suspending Section 321, all ecommerce and cross-border retail shipments—previously benefiting from this exemption—will now be subject to tariffs. These changes will have major ripple effects, the first of which is the impact on global ecommerce brands who will need to quickly change their international fulfillment strategies.

Included in the executive action are a 25% tariff on imports from Canada and Mexico, (effective March 4, 2025), and an additional 10% tariff on imports from China – bringing the total to 20% since February 1, 2025.

The use of Section 321 has surged over the past decade as ecommerce brands sought to reduce costs and maximize profits on direct-to-consumer (DTC) sales. According to US Customs and Border Protection (CBP), de minimis shipments made up 92% of all cargo entering the US. However, the sudden suspension of Section 321 will have brands scrambling to find alternative fulfillment strategies to avoid disruptions and much higher costs.

With this shift, many brands that previously relied on Section 321 will likely transition to US-based fulfillment providers to maintain efficiency and cost control. As companies reassess their logistics operations, finding the right domestic ecommerce fulfillment partners will be essential to sustaining seamless DTC shipping and minimizing the impact of new tariffs.

Key Trade Policy Updates (as of March 3, 2025)

Below are the most recent trade policy updates related to Trump’s executive orders to suspend Section 321, and impose tariffs on imports to the US.

De Minimis Threshold Changes

- The de minimis threshold for goods originating from China entering the U.S. has effectively been reduced to zero effective Tuesday, February 4, 2025 but reinstated Friday, February 6, 2025. The reason that 321 for Chinese goods was reinstated was that the CDP needs time to process imports more efficiently.

- The removal of the de minimis exemption for Mexican and Canadian-origin goods is currently on hold, pending methods to collect duties from low-coast goods.

- For all other imports, the US de minimis threshold remains $800.

New US Tariffs on Imports

- China-origin goods: 20% tariff on imports. This is in addition to the existing tariffs that can range from 7.5% to 100%

- Canada-origin goods: 25% tariff, except for energy resources, which will face a 10% tariff (effective March 4, 2025).

- Mexico-origin goods: 25% tariff (effective March 4, 2025).

Retaliatory tariffs

- Canada and Mexico announced plans of retaliatory tariffs on US goods, but have placed them on hold pending negotiations.

Understanding Section 321: Duty-Free Imports for Low-Value Shipments

Section 321 is a US Customs and Border Protection (CBP) designation that allows goods to be imported duty-free, provided they meet the de minimis value threshold. Currently set at $800 USD, this means most shipments valued at or below this amount can enter the US without incurring customs duties, import taxes, or tariffs. This provision is particularly beneficial for ecommerce businesses that ship low-value goods directly to consumers. Read the complete guide to section 321 for more information.

CBP manages these shipments through different data pilot programs. Section 321 is released on the manifest data, whereas Entry Type 86 (T86) is a formal customs entry that extends Section 321 benefits to shipments requiring Partner Government Agency (PGA) oversight. T86 entries use the Automated Commercial Environment (ACE) system, providing better supply chain visibility while requiring additional data elements for compliance. While most commodities qualify under T86, understanding the distinction between Section 321 and T86 is crucial for optimizing cross-border logistics.

What is the Immediate Impact of Brands Leveraging Section 321

When a suspension of Section 321 takes effect, brands that previously benefited from duty-free imports will now face significant tariffs and taxes on goods sold to US customers.

This change presents an immediate financial challenge, forcing brands to either absorb the increased costs—reducing profit margins—or pass them onto consumers through price adjustments. For many DTC businesses, even small cost increases can disrupt pricing strategies, conversion rates, and overall competitiveness in an already tough market.

Beyond the financial impact, the logistics and operational complexities of cross-border shipping will increase significantly. All imports, regardless of the value, will now require:

- Formal customs entries for every shipment

- Additional processing and paperwork, increasing administrative overhead

- Full payment of newly imposed tariffs on all imports

- Significantly longer transit times, creating potential delays for customers

- A decision on who absorbs the costs—either the brand or the end customer

Previously, Section 321 allowed for a streamlined import process, enabling brands to move goods quickly and cost-effectively. Now, with these new barriers in place, brands operating at high volumes will face slower, more complex fulfillment workflows, making cross-border DTC shipping less viable.

To adapt, many businesses will need to explore alternative order fulfillment strategies, such as US-based warehousing, to maintain cost efficiency, delivery speed, and a seamless customer experience while avoiding customs bottlenecks and unexpected tariffs.

For Ecommerce Brands Shipping to the US

- Elimination of de minimis threshold: Previously, goods valued under $800 USD could enter the US duty-free under the de minimis rule. Now, all shipments of Chinese-origin goods are subject to tariffs and duties regardless of value. As of now, this only applies to Chinese-made, but will likely affect Canadian and Mexican-made goods in the near future.

- Tariffs apply based on country of origin, not shipment location: For example, a product made in China but shipped from France to the US would still incur the 10% tariff on Chinese goods. Likewise, a product made in Indonesia but shipped from China would not incur the tariff.

- Increased landed costs: The new tariffs will raise the total cost of goods sold in the U.S., potentially affecting pricing strategies and profit margins.

- Enhanced customs compliance: Merchants must now navigate more complex customs procedures, including detailed documentation and potential delays, due to the removal of the de minimis exemption.

For US Ecommerce Brands Shipping to Canada and Mexico

- Tariffs on hold: The planned 25% retaliatory tariffs on U.S. goods entering Canada and Mexico have been paused for one month pending negotiations.

- Ongoing uncertainty: Businesses should remain prepared for potential cost increases if negotiations do not result in a permanent resolution.

How Brands can Adapt to the Section 321 Suspension

Brands previously importing goods under Section 321 must now rethink their fulfillment strategies to mitigate the impact of new tariffs and logistical challenges. One option is to shift fulfillment to the US, allowing brands to store inventory closer to customers.

While this means paying tariffs upfront, it eliminates the risk of customs delays, ensures faster shipping times, and provides greater control over fulfillment operations. Though this approach requires some logistical adjustments, it offers long-term stability and operational efficiency in a post-321 landscape.

Some brands may prefer to maintain their existing cross-border fulfillment operations and take a wait-and-see approach. This allows businesses to continue shipping from their current facilities without immediate disruption, with the hope that policies may change or exemptions could be introduced.

However, this strategy comes with risks, including longer transit times, customs bottlenecks, and increased shipping costs. Regardless of which path a brand chooses, staying proactive and flexible in response to evolving trade regulations will be critical to maintaining a seamless DTC operation and minimizing potential disruptions.

Continuing to Import DTC Goods into the US: Type 1 versus 11 versus Type 86 Entry

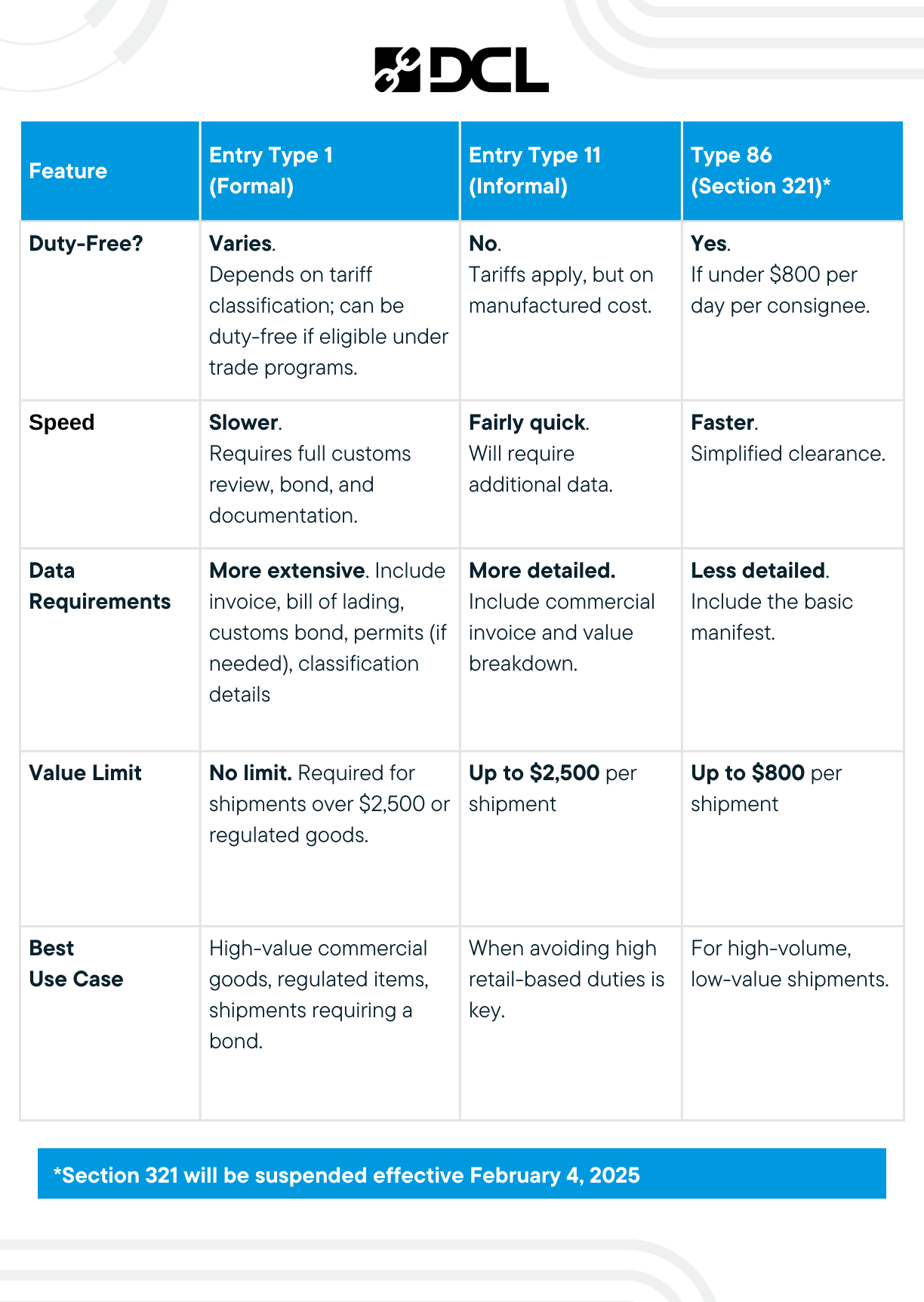

When importing goods into the US, brands must consider the best customs clearance method to minimize costs and maximize efficiency. Three commonly used entry types are Entry Type 1 (Formal), 11 (Informal Entry) and Type 86 (Section 321).

- Entry Type 86 allows duty-free clearance for shipments valued under $800 per day per consignee, making it ideal for high-volume, low-value direct-to-consumer (DTC) shipments. However, with the suspension of Section 321 this will no longer be an option.

- Entry Type 11 (Informal) allows importers to declare the manufactured cost (rather than the retail price) as the dutiable value. This provides an alternative option for importers to reduce tariff expenses; the manufactured cost is almost always lower than the retail value, offering importers a higher chance of goods entering under the de minimis threshold.

- Type 1 (Formal Entry) is required for commercial shipments over $2,500 or those subject to regulations, quotas, or additional duties. It involves more documentation, including a customs bond, and typically takes longer to process due to CBP review. This entry type is best for high-value, commercial imports that will be resold or used in business operations.

Before jumping to change the entry type of your goods, considerations should be made. Using Entry Type 86 allowed for faster customs clearance and required minimal documentation, Type 1 and 11 requires more detailed data documentation, such as a commercial invoice with a full value breakdown.

For brands choosing to use Entry Type 11, they may see reduced duty payments, which is especially valuable for businesses with products such as electronics, apparel, and beauty, where retail markups can be significant. Below is a comparison of these three entry types:

Bottom Line

The suspension of Section 321 marks a significant turning point for ecommerce brands that have long relied on duty-free cross-border fulfillment to serve US customers. As tariffs and customs requirements become more complex, businesses must act swiftly to reassess their supply chain strategies and adapt to the new reality.

Whether by transitioning to US-based fulfillment, exploring alternative international logistics solutions, or closely monitoring potential policy changes, brands that take a proactive approach will be best positioned to minimize disruptions and maintain customer satisfaction.

While these changes introduce new challenges, they also present an opportunity for brands to optimize their fulfillment models for long-term resilience. The brands that invest in efficient logistics, strategic warehousing, and strong fulfillment partnerships will not only mitigate immediate risks but also set themselves up for sustainable growth in an evolving global trade environment. With the right strategies in place, businesses can continue to deliver a seamless DTC experience, despite the shifting regulatory landscape.

If you’re looking for a 3PL partner to help you navigate the Section 321 suspension, DCL Logistics offers a range of fulfillment solutions to keep your operations running smoothly. Whether you need guidance on adapting to these changes or optimizing your fulfillment strategy, we’re here to help. Reach out to us to explore your options.

We own and operate facilities in The Bay Area, Los Angeles, Kentucky, and the East Coast.

Be sure to review the list of services we offer, including ecommerce fulfillment, retail fulfillment, Amazon fulfillment services, reverse logistics, transportation management, and kitting & assembly.

This post was written by Brian Tu, Chief Revenue Officer at DCL Logistics. Brian brings over 20 years of sales and sales operations experience and now leads DCL’s sales, marketing and client service areas. Brian joined DCL from the digital media industry, most recently from Medium, where he ran their revenue operations business.

Tags: International