Kermit McKinney is a dynamic business leader with a proven track record in business development, strategic partnerships, supply chain and fulfillment, and growing revenue across multiple industries. Currently at Zonos, he brings decades of leadership experience—including founding and scaling companies, securing major retail placements, and driving operational excellence—to his role building third-party logistics partnerships.

For ecommerce brands expanding into international markets, pricing transparency isn’t just a best practice—it’s the linchpin of a positive customer experience.

Some businesses may not understand the nuanced details of international shipping costs, thus underestimating how duties and taxes may be contributing to cart abandonment or customer retention issues.

Duties and taxes play a critical role in the global buying journey and brands must be transparent with customers if they will be responsible for their cost. Surprise fees at delivery are a leading reason why international packages are rejected or abandoned at customs—which result in customer dissatisfaction, and ultimately lost revenue for your brand.

Why Transparent Pricing Matters More for International Shipping

Domestic customers are used to seeing the final price at checkout—taxes, shipping, etc. International customers, however, often leave the checkout blind. They may not understand that other fees may be due at the time of delivery, let alone how much.

When fees appear later in the process—especially at the door—shoppers can feel misled. That lack of clarity causes:

- Cart abandonment

- Package rejection upon delivery

- Negative reviews and reduced customer lifetime value

- Increased strain on customer support

Providing a clear, total price up front prevents these outcomes and builds brand trust from the start. Pricing transparency is not only a way to reduce confusion but also a proactive approach to increasing long-term revenue.

What Are Duties and Taxes, Really?

Duties and taxes are distinct fees imposed by a country’s customs authority when goods cross borders.

- Duties are charges based on the type and value of the goods being imported. They are typically calculated using product classification codes (HS codes) and help protect domestic industries.

- Import taxes—such as VAT or GST—are government-imposed taxes on imported goods, usually calculated as a percentage of the item’s value and often required regardless of product type.

These costs vary based on:

- Product classification (via HS codes)

- Country of origin and destination

- Applicable trade agreements

Unlike a simple sales tax, duties and import taxes often require correct documentation, valuation, and sometimes local tax registration or remittance. Failure to calculate them correctly can mean fines, delays, or non-compliance.

Why this matters: You can’t offer pricing transparency without knowing how duties and taxes work. And without transparency, your international customer experience will suffer.

What Happens When Duties and Taxes Aren’t Shown at Checkout?

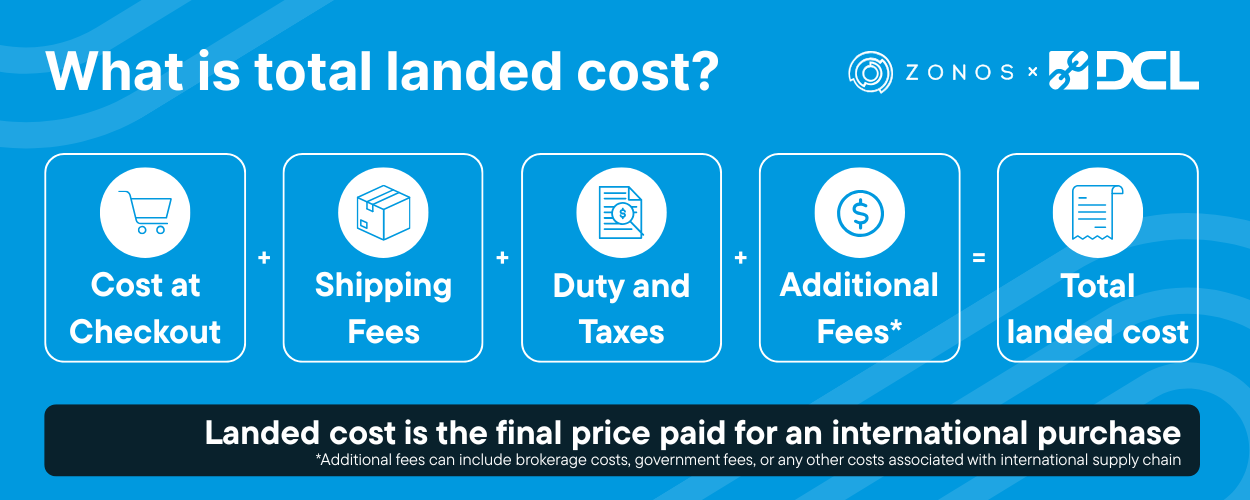

If your checkout doesn’t estimate and display the total landed cost—including duties and taxes—customers can be hit with unexpected fees later. That lack of transparency leads to two main outcomes:

- Cart abandonment: Some savvy shoppers know duties and taxes may apply but aren’t shown. If costs aren’t clear, they’ll often leave the checkout before completing the purchase.

- Post-purchase fallout: When customers are surprised by fees after ordering—especially at delivery—they may:

- Reject the package: Refuse to pay the carrier’s invoice. In some countries, rejected packages can’t be returned and are destroyed. If returned, it often costs more than the item’s original value.

- Request a refund: The merchant may still be expected to refund the order, compounding the loss.

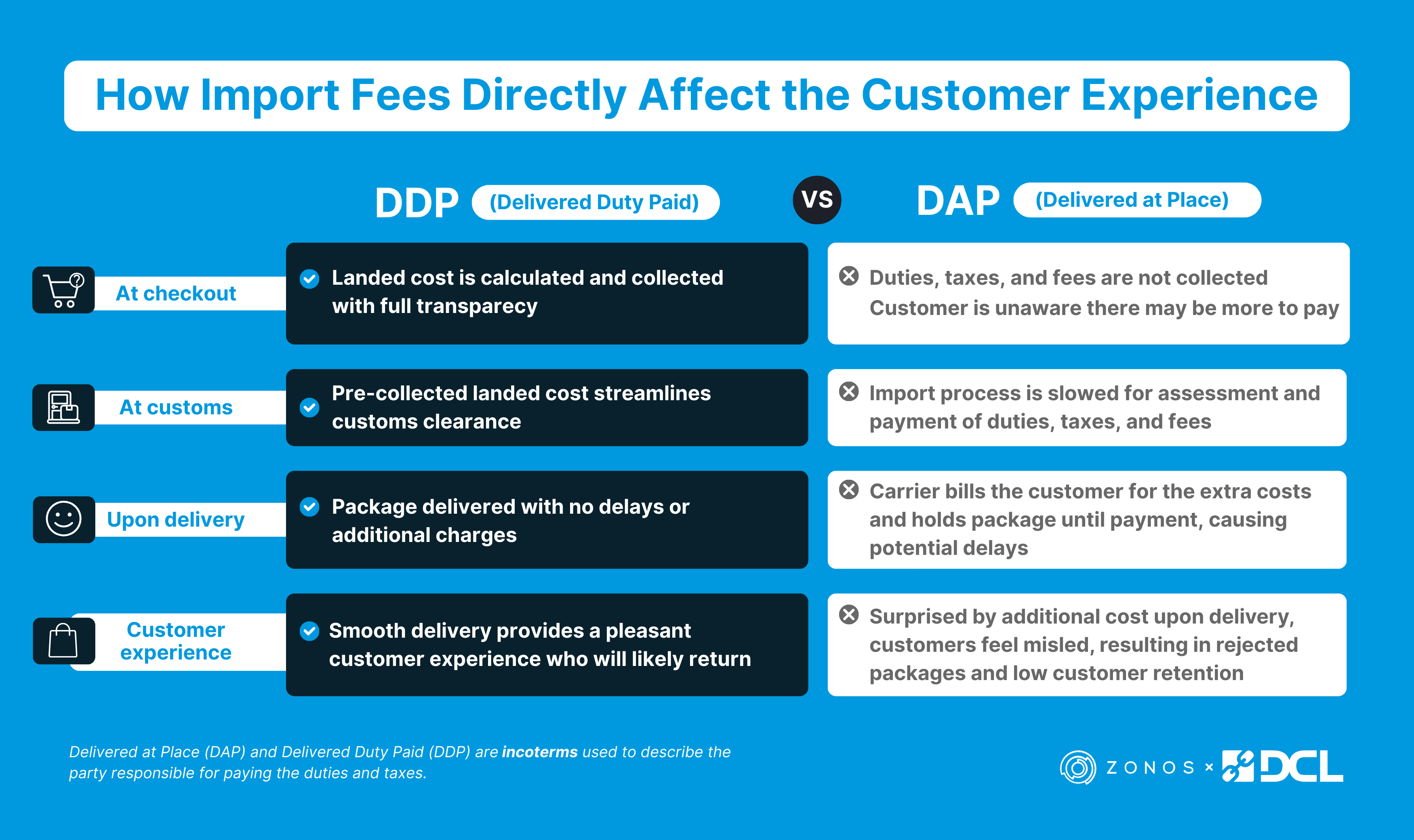

DDP vs. DAP: The Difference is Risk

There are two main options when it comes to collecting duties and taxes on international orders:

- DDP (Delivery Duties Paid): All fees are prepaid at checkout. Best practice. Cleaner, faster delivery and happier customers.

- DAP (Delivered at Place): The customer pays fees upon delivery. Risky. Often leads to rejection and poor experiences.

Why this matters: DDP provides full pricing transparency. DAP doesn’t. If you want to reduce friction and grow international sales, DDP should be your default.

Best Practices for a More Transparent Checkout for International Customers

Displaying duties and taxes up front builds trust and drives conversions. According to DHL’s 2023 global online shopping report, 47% of international shoppers prefer to have duties and taxes present at checkout to feel reassured in their purchase.

Transparency is key to deliver a positive, frictionless experience for international customers. Best practice is to include the following in your international checkout flow:

- Accurate product classification (HS codes)

- Country-specific tax schemes

- Prepaid fees (DDP)

Automation tools enable brands to calculate guaranteed, accurate landed costs in real time, based on current trade regulations and tax structures. Reliance on high-quality tools will make the difference when scaling your ecommerce operations. Look for ones that offer:

- Automated HS code classification on the fly at checkout

- Clear display of duties/taxes at checkout

- Offer prepayment options to customers

- Take on the tax compliance risk for you

Why this matters: Manual management of global trade compliance isn’t scalable. Automation saves time, reduces errors, and protects profit margins. It also allows teams to focus on strategic growth initiatives instead of being bogged down by regulatory complexity and upset customers–and proactive support yields much more sustainable growth than reactive support.

Final Takeaway: Be Transparent or Be Left Behind

Duties and taxes aren’t just a line item—they’re a defining part of your international customer experience. Providing full pricing transparency at checkout is no longer a nice-to-have; it’s a necessity for building loyalty, reducing risk, and growing your brand globally.

If you’re not showing duties and taxes at checkout, ask yourself: what are surprise fees really costing your business?

About Zonos

Founded in 2009, Zonos is an API-first technology company specializing in cross-border ecommerce solutions. We pride ourselves on our mature technology infrastructure, which is continuously fortified with cutting-edge features to meet the evolving needs of our customers. We embrace innovation, leveraging AI capabilities to enhance the functionality and intelligence of our solutions.

Zonos accurately calculates the true cost of cross-border purchases before and at checkout, eliminating surprises for both sellers and shoppers. We simplify cross-border compliance and risk with accurate HS code classification, item restriction data, and pre-paid duties, taxes, and fees. We make global ecommerce as easy as domestic—so shippers can unlock more sales with less effort.

Tags: International