In ecommerce inventory management, ending inventory (or closing inventory) holds significant importance. It refers to the value of goods that remain in stock at the end of an accounting period. Calculating ending inventory accurately is crucial for determining the cost of goods sold (COGS) and maintaining accurate inventory.

The intricacies of ending inventory, and the methods of calculating, play a significant role in financial reporting and assessing the financial health of a business.

The Significance of Ending Inventory

- Inventory Management: Ending inventory plays a pivotal role in the broader scope of inventory management. It represents the remaining stock of finished goods, work-in-process, and raw materials, providing a snapshot of the company’s current assets at the end of the accounting period.

- Financial Reporting: Ending inventory directly impacts financial statements, such as the income statement and balance sheet. It contributes to calculating the cost of goods sold and is essential for evaluating a business’s financial performance and profitability.

- Metrics and Analysis: Accurate tracking of ending inventory enables businesses to assess inventory turnover, measure gross margin, and identify inventory shrinkage. These metrics aid in making informed decisions for optimizing inventory levels and improving operational efficiency.

Calculating Ending Inventory: Methods and Formulas

- Beginning Inventory: Calculating ending inventory often involves considering the beginning inventory, which represents the value of goods at the start of the accounting period.

- Purchases and Production: Adding net purchases and the cost of goods produced during the accounting period to the beginning inventory yields the total goods available for sale.

- Cost of Goods Sold (COGS): Determining the COGS during the period allows for the separation of the total goods available for sale from the goods sold, resulting in the ending inventory value.

- Ending Inventory Formula: The formula for ending inventory is the sum of the beginning inventory and the net purchases, minus the COGS. The formula for ending inventory is: Ending Inventory = Beginning Inventory + Net Purchases – COGS.

Different Inventory Valuation Methods

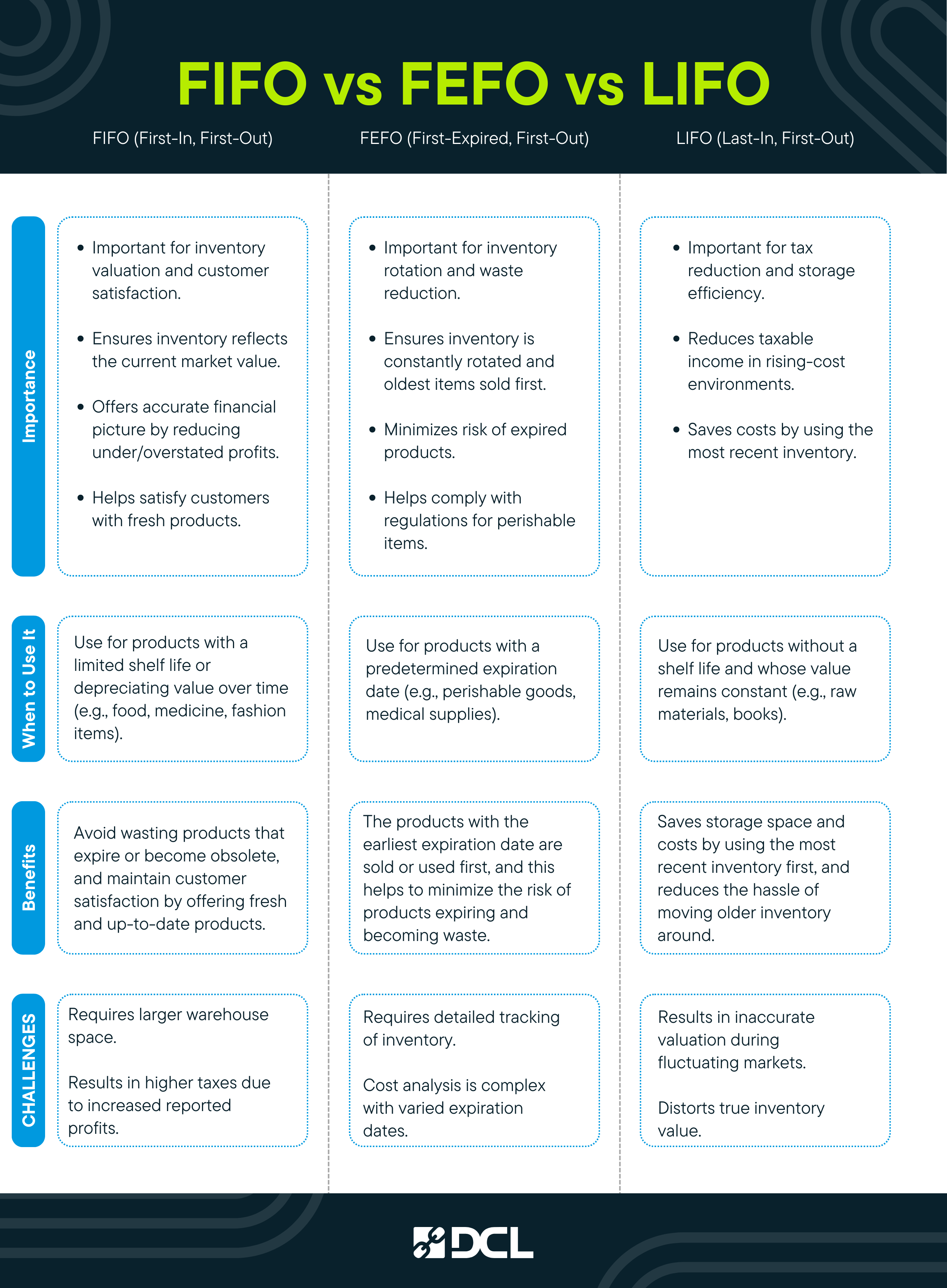

- FIFO (First In, First Out): The FIFO method assumes that the first items purchased or produced are the first ones sold, leaving the recent inventory in stock, and thus affects the calculation of the ending inventory and the COGS.

- LIFO (Last In, First Out): In contrast, the LIFO method assumes that the recent inventory is sold first, impacting the ending inventory and COGS differently from the FIFO method.

- Weighted Average Method/Weighted Average Cost(WAC): This method calculates the average cost of inventory during the accounting period, which is then used to determine the value of the ending inventory and the COGS.

It’s worth noting that there are other valuation methods than just the three listed here. When choosing your inventory valuation method, it’s important to consider more than just the items themselves.

The Role of Ending Inventory in Financial Statements

- Balance Sheet: Ending inventory is recorded as a current asset on the balance sheet, representing the value of unsold goods available for future sales.

- Income Statement: The accurate calculation of ending inventory is vital for determining the COGS, which is subtracted from the total revenue to calculate the gross profit, eventually impacting the net income of the business.

- Gross Margin Analysis: Ending inventory contributes to the calculation of the gross margin, which is essential for evaluating the profitability of the company’s operations.

Challenges in Ending Inventory Calculation

- Time-Consuming Process: Performing physical inventory counts and calculating the value of the ending inventory can be a time-consuming task, especially for businesses with a large number of inventory items.

- Inventory Shrinkage: Inaccuracies in inventory tracking can lead to discrepancies between the recorded inventory and the actual inventory, resulting in inventory shrinkage and affecting the calculation of ending inventory.

- Real-Time Inventory Management: For ecommerce and retail businesses, the need for real-time inventory updates is crucial for maintaining accurate records of the ending inventory.

Importance of Accurate Ending Inventory

- Ecommerce and Retail: Accurate tracking of ending inventory is critical for ecommerce and retail businesses to ensure that the products listed for sale are in stock and readily available for customers.

- Forecasting and Demand Planning: The value of the ending inventory aids businesses in forecasting future demand, making informed purchasing decisions, and avoiding stockouts or overstock situations.

- Inventory Management Software: Utilizing advanced inventory management software streamlines the process of tracking and calculating ending inventory, enhancing accuracy and efficiency in inventory management.

The Retail Method and Other Considerations

- Retail Method: In the retail industry, the retail method is employed to estimate the value of ending inventory by applying the cost-to-retail ratio to the ending inventory at retail prices.

- Inventory Valuation Adjustments: Businesses may need to make adjustments to the ending inventory value based on changes in market value, markdowns, or obsolete inventory.

- Forecasting Accuracy: Accurate ending inventory data is crucial for maintaining precise forecasting, ensuring that the right amount of inventory is available to meet customer demand without excessive stock levels.

Bottom Line

In inventory management and financial reporting, ending inventory serves as a critical indicator of a business’s financial health and operational efficiency. Accurately calculating the ending inventory through various valuation methods and formulas is essential for generating reliable financial statements, making informed business decisions, and ensuring smooth operations in various industries, including ecommerce, retail, and manufacturing.

Adopting robust inventory management practices and leveraging innovative software solutions can streamline the process, leading to more accurate ending inventory data and improved business performance.

Help with inventory management is one of the many benefits to working with a 3PL. If you are seeking logistics support we’d love to hear from you. You can read DCL’s list of services to learn more, or check out the many companies we work with to ensure great logistics support. Send us a note to connect about how we can help your company grow.