If you’re an ecommerce leader selling internationally, you’ve likely felt the turbulence of recent trade policy changes. Recent developments under the Trump administration have introduced new tariffs affecting key trading partners, notably Canada, China, and Mexico and more recently, the EU and UK.

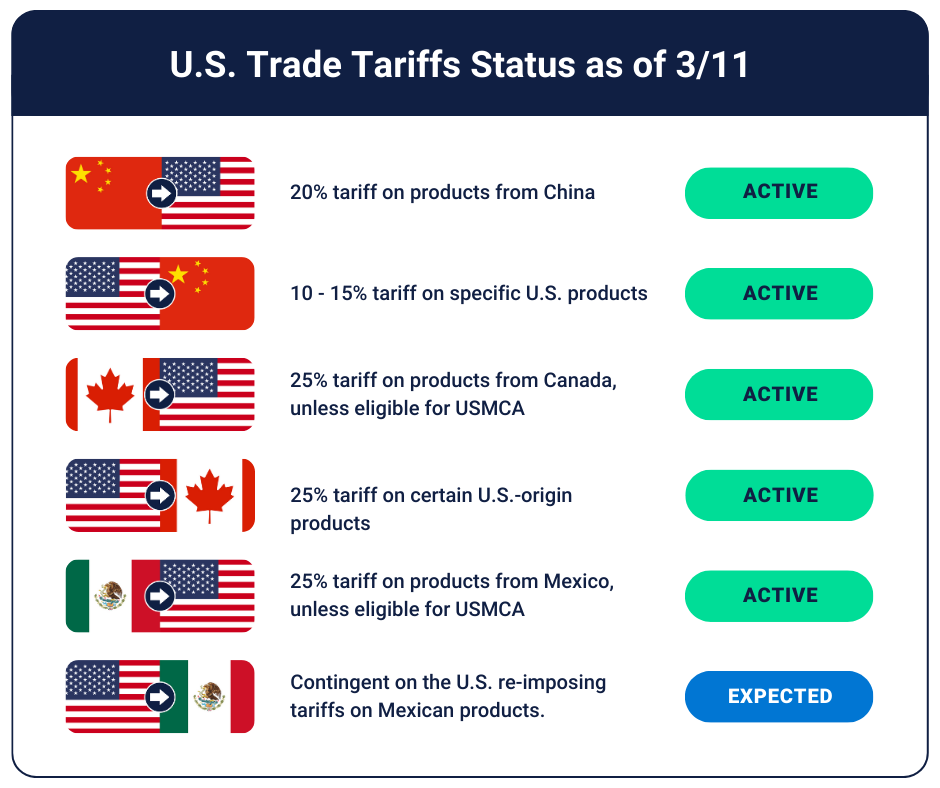

Let’s breakdown the current landscape:

- Canada: As of March 4, 2025, the U.S. has imposed a 25% tariff on all Canadian imports, with a reduced rate of 10% on energy products such as crude oil and natural gas. Goods that qualify for USMCA are temporarily exempted from this additional duty. In response, Canada has implemented retaliatory 25% tariffs on U.S. goods, further escalating trade tensions.

- China: The US increased tariffs on Chinese goods from 10% to 20%, effective March 3, 2025, aiming to address trade imbalances and other concerns. China has retaliated with its own 10-15% tariffs on U.S. products, affecting various sectors.

- Mexico: Similar to Canada, a 25% tariff has been imposed on Mexican imports as of March 4, 2025. Goods that qualify for USMCA are temporarily exempted from this additional duty. Mexico has announced intentions to implement countermeasures, adding to the complexity of the trade environment.

At Passport, we recently commissioned Drive Research to survey 100 ecommerce leaders to better understand ecommerce trends, challenges, and how they’re responding to the shifting trade landscape. The initial results are striking: over 81% of ecommerce leaders said they were somewhat or very concerned about tariffs and their impact on international commerce strategy. In fact, this was the second highest concern when it came to overall ecommerce growth, right behind technology/website concerns.

It’s clear that brands aren’t just watching these changes—they’re worried about how to stay competitive and compliant. While no one can predict exactly how trade policies will unfold, brands that take proactive steps today will be best positioned to succeed.

Here’s how you can future-proof your international strategy:

1. Stay Informed on Trade Developments

The situation is evolving by the minute, and brands need real-time insights to make informed decisions. That’s why we built TrumpTradeTracker.com, a tool that allows ecommerce leaders to track tariff updates, trade policies, and potential impacts on their businesses.

Staying ahead of global trade changes can help brands pivot their sourcing, pricing, and logistics strategies before unexpected costs arise.

2. Move Inventory In-Country for Local Fulfillment

Many brands are shifting from cross-border shipping to in-country enablement to bypass tariffs, reduce duties, and improve delivery times. This trend is particularly strong in Canada, the UK, and the EU, where ecommerce brands are increasingly stocking inventory locally to avoid fluctuating trade policies and costly import duties.

Why this strategy works:

- Eliminates tariffs on finished goods – Instead of shipping products across borders and paying new import duties, fulfillment within the country allows for domestic shipping rates and fewer trade restrictions.

- Shortens delivery times – Consumers expect fast, affordable shipping. Local inventory means quicker delivery and better customer satisfaction.

- Improves the returns process – International returns are costly and slow when shipping cross-border. By having local fulfillment centers, brands can offer seamless, customer-friendly returns, leading to higher repeat purchase rates.

- Opens the door for marketplace expansion – Platforms like Amazon, Zalando, and ASOS prioritize local sellers with inventory in-country. This strategy helps brands qualify for premium placements and faster fulfillment services.

While continuing to ship cross-border is still a sound international strategy for many companies in the majority of global markets, bringing inventory locally in high-demand markets is a sound strategy, especially given the shifting tariff policies.

3. Ensure Proper HS Code Classification & Compliance

One of the biggest risks for brands today is misclassification of HS codes (Harmonized System codes), which can lead to overpaying on tariffs and duties—or worse, unexpected fines and shipment delays or seizures. Compliance isn’t just about avoiding extra costs; it’s about ensuring your products move smoothly through customs without disruptions and that your pricing remains competitive in global markets.

Misclassification often happens because HS codes are complex and country-specific, meaning a code that works in one market may not be correct in another. Additionally, tariff structures evolve, and failing to update classifications can lead to higher duty rates over time. Certain product categories—such as footwear, apparel, and bundled products—require extra scrutiny due to shifting classification rules and special tariff considerations.

Brands should work with experts in trade compliance who can:

- Ensure accurate HS code classification to avoid overpaying on duties

- Regularly review and update product classifications as tariff regulations change

- Use preferential trade agreements to reduce duty costs where applicable

- Carefully classify bundled or multi-component products

- Maintain precise and detailed product descriptions, as customs officials rely on these when verifying classifications

Several countries, including Canada, the UK, and the EU, offer free HS code lookup tools. While these resources provide a useful starting point, they often lack the detail required for precise classification, particularly for complex product categories where classification may vary based on an item’s use or composition.

Additionally, classifications beyond the six-digit HS level require more expertise. In a September 2022 ruling, US Customs and Border Protection (CBP) clarified that for US import, only licensed customs brokers can classify products beyond this universal six-digit level. This means brands relying solely on free tools may still need expert validation.

Example: A US brand selling skincare products to Europe may face 18% tariffs if classified incorrectly under luxury goods but just 5% if classified under general skincare items. A minor misclassification like this could add up to thousands in unnecessary fees over time.

Getting HS codes right isn’t just a regulatory requirement—it’s a critical factor in protecting your brand’s revenue and delivering a seamless customer experience.

About Passport

Passport helps ecommerce brands navigate trade complexities with ease. Whether it’s setting up proper duty and tax collection, managing cross-border shipping, or enabling in-country fulfillment with partners like DCL Logistics, we provide end-to-end solutions for scaling internationally.

Founded in 2017, Passport is a global ecommerce solutions provider that empowers merchants—like Dolls Kill, Ridge, Ogee, OneSkin, and HexClad—to grow profitably and confidently in over 180 countries. Combining innovative technology, global logistics, and expert compliance and growth support, Passport delivers the right solutions for the right markets at every stage of global growth.

To learn more about the company, offerings, and careers, visit passportglobal.com. And for up-to-date information on U.S. tariffs and global trade policies, visit trumptradetracker.com.

This post was written by Alex Yancher, CEO & Co-Founder of Passport.

Tags: International