UPS, FedEx, USPS, and DHL: Comparing Domestic Shipping Options for Small Packages [+Infographic]

Sellers are always looking for cost effective shipping solutions to get their products to customers faster without sacrificing reliability and quality. Companies who sell smaller items, anything under 10lbs—consumer electronics, health and beauty supplies, or consumer packaged goods—have a few options for their small parcel shipping strategy.

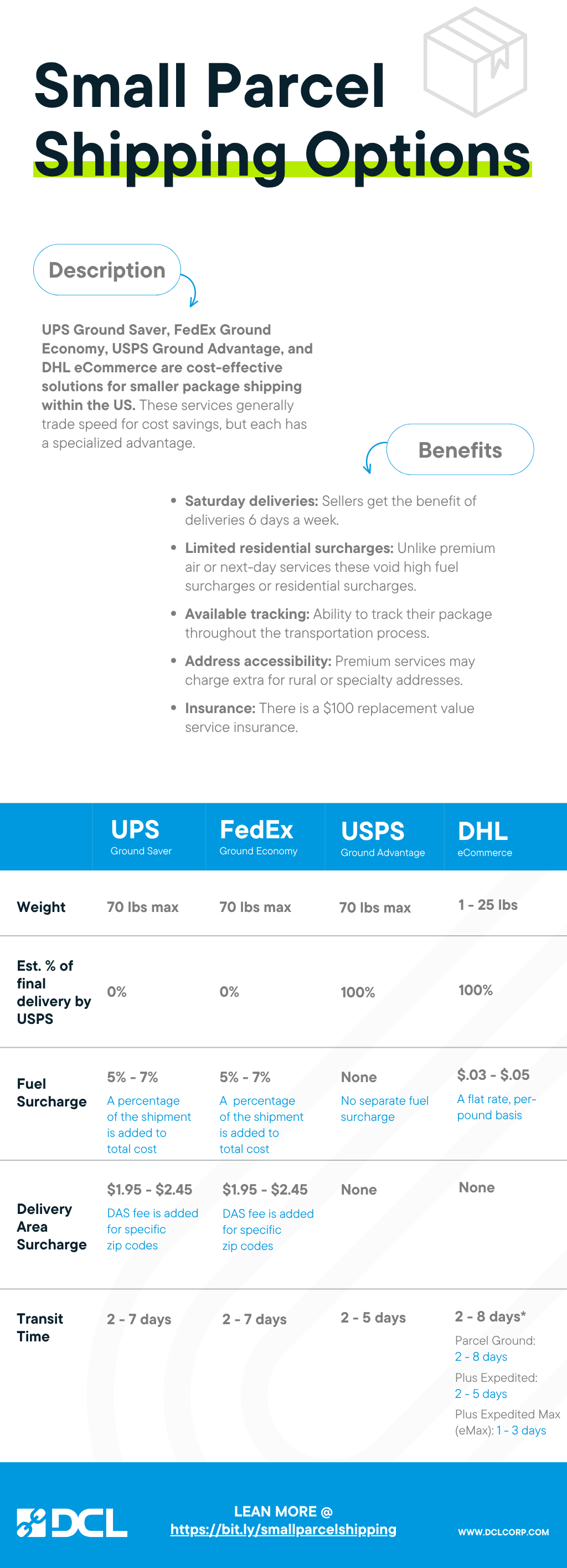

The most common for ecommerce brands are USPS Ground Advantage, UPS Ground Saver (formerly Surepost), FedEx Ground Economy (formerly Smartpost), and DHL Small Parcel (and Parcel Plus) Expedited. All three have similarities, yet some distinct differences, yet many companies may not know which one is truly right for their products and brand.

As the carrier industry shifts (and these services change), to meet the rising growth fo the ecommerce industry, brands need to fully understand which service is best for their products and their customers.

Now more than ever sellers are highly incentivized to find ways to optimize their shipping, to meet the needs of their customers, whether that’s faster or more affordable, or a mix of both.

If you’re interested in tracking carrier transit times, view our article and interactive chart that maps the average transit times for each of the major domestic carriers over time.

Benefits: UPS Ground Saver, USPS Ground Advantage, FedEx Ground Economy, and DHL eCommerce

These four services — USPS Ground Advantage, UPS Ground Saver, FedEx Ground Economy, and DHL Small Parcel/Parcel Plus Expedited — excel because they offer a strong balance of cost-efficiency, broad delivery reach, and reliable performance without the premium price tags of expedited air or guaranteed next-day options.

These are each carrier’s solution, designed for shippers who don’t need speed at all costs, making them ideal for many ecommerce brands, like subscription boxes and other non-urgent deliveries. The savings seen with these can significantly improve margins.

On average, sellers can expect to save 20%-30% on shipments when compared to other residential ground shipping options, or expedited options like air or next-day. While the other services might be faster, the cost savings recognized might be enough to deter the end-customer from buying (especially for small, lightweight items like refills, or consumables.)

In addition to cost savings, there are a number of benefits all three services provide, including:

Saturday deliveries: Sellers get the benefit of deliveries six days a week without incurring additional fees.

Fewer surcharges: Unlike premium air services, small parcel ground services avoid high fuel surcharges and dimensional pricing penalties, while still maintaining professional tracking and dependable transit windows.

Available tracking: Tracking provides the seller and end consumer the ability to track their package throughout the transportation process. Services that hand over to USPS for last mile delivery (DHL and OSM) may have limited tracking.

Access to more addresses: These services deliver to more addresses and delivery scenarios — such as rural homes or cross-border ground lanes — that premium services may charge extra for or cannot reach directly. Although USPS and DHL (with USPS as last-mile) have the widest address availability of all – including military addresses and PO boxes.

Insurance: Most of these services have a $100 replacement value service insurance in the event the package is lost or damaged while in the hands of the carrier.

Differences: Ground Saver, Ground Advantage, Ground Economy, and Parcel Plus Expedited

While all three services share the primary attribute of offering a cost-effective solution for selling shipping small packages, there are important differences between them that a seller must understand during their evaluation process. Some of these differences may seem trivial, but could ultimately have a major impact on the shipping costs and delivery speeds.

Another factor that sellers need to account for when calculating shipping costs that vary by carrier is dimensional weight (DIM). While physical weight is the weight of the shipment according to the scale, dimensional weight is calculated based on the package’s length, width, and height.

Each service has a different DIM factor that is used to calculate final shipping costs. Understanding the different DIM factors for each service is important as the cost difference can be meaningful, especially for sellers who have lite weight shipments in large boxes.

It’s important sellers factor in dimensional weight (DIM) early on in the packaging design process. While actual weight is the primary way the shipping cost is determined, the DIM can add material costs. DIM becomes a more significant factor for sellers with large, light weight packages.

Did you know DIM factor is something you can negotiate? Each carrier has a default DIM factor denominator of 166. The start of your contract with a shipper is the only time you can negotiate a lower DIM factor.

UPS Ground Saver

UPS Ground Saver — which evolved from the SurePost hybrid product — is now positioned as a UPS-handled ground tier that no longer relies on USPS for final-mile delivery.

Tracking: As a fully UPS-managed service, Ground Saver emphasizes predictable UPS pickup, long-haul handling, and unified UPS tracking across the entire route. That change improves end-to-end visibility, reduces handoff-related delays, and generally offers a more consistent residential delivery experience than hybrid models.

Fuel: UPS Ground Saver has a fuel charge for every package which varies by month. It can change annually and based on the market, but on average, sellers should expect to pay between 5% to 7% fuel surcharges in addition to initial shipping cost. Fuel surcharges are disclosed upfront and quoted when the order is initially processed and shipped.

DIM: Ground Saver uses dimensional weight (DIM) for shipping calculations.

Delivery Area Surcharges: Some accessorial charges like Delivery Area Surcharges may be added to the shipments once the shipment is delivered. Delivery area surcharges are added to specific zip codes, primarily because they are in hard to reach or rural areas. These fees can range between $1.95 and $2.45 but impact less than 10% of the US zip codes. Most sellers won’t be materially impacted by these surcharges.

Pricing is typically set below full-service UPS Ground but above the cheapest postal options, making Ground Saver attractive for businesses seeking a middle ground: better tracking and fewer handoffs than a hybrid, but still competitive pricing for residential parcels.

FedEx Ground Economy

FedEx Ground Economy (the successor to FedEx SmartPost) traditionally targeted low-cost residential deliveries by combining FedEx’s long-haul network with local last-mile partners (historically USPS).

Fuel: FedEx Ground Economy has fuel and accessorial surcharges similar to UPS Ground Saver. They charge between 5% and 7% fuel surcharge which is disclosed and charged upfront. They also follow a very similar model for delivery area surcharges. The specific zip codes between Ground Economy and Ground Saver vary between the two services.

DIM: Like UPS, FedEx factors the dimensional weight (DIM) for every package, regardless of dimensions or weight, so both physical weight and DIM weight are considered when calculating the cost of the shipment.

It’s typically economical for low-weight, non-time-sensitive parcels headed to homes and emphasizes cost and environmental efficiency over speed. The hybrid delivery model can lead to slower transit and occasional tracking gaps at handoff, but it usually comes with FedEx’s streamlined pickup options and network reliability for the bulk of the trip. Use Ground Economy when price is the priority and delivery can tolerate a broader window.

USPS Ground Advantage

USPS Ground Advantage is the Postal Service’s answer and competitor to the hybrid solutions once offered by UPS and FedEx (Surepost and Smartpost, respectively).

The Postal Service consolidated it’s economy ground products for domestic parcels and created Ground Advantage aimed at cost-sensitive shippers who can tolerate a multi-day window (typically about 2–5 business days depending on zones).

Fuel: Ground Advantage does not include a separate fuel surcharge. Instead, any fuel-related cost fluctuations are already baked into the published postage rates. There’s no visible, additional percentage for fuel.

Tracking: Tracking has improved since the consolidation but is still more basic than the parcel carriers’ premium offerings.

Address Accessibility: The service’s strength is broad access to drop-off points. USPS delivers to more addresses domestically than any other carrier, including P.O. Boxes and Military Addresses.

Ground Advantage is generally a low cost option for lighter packages; the availability of flat-rate or free packaging helps control costs. This is a good choice when price and convenience (many post office locations and free pickups) outweigh the need for minute-by-minute tracking or guaranteed day-specific delivery.

DHL eCommerce Domestic

Unlike FedEx and UPS, the DHL domestic small parcel services still rely on USPS for final-mile delivery. This gives them a wider access to addresses and domestic shipping infrastructure, to offer low-cost solutions for domestic shippers.

Fuel: DHL eCommerce has a flat rate fuel surcharge that is charged by the pound which differs from the percentage rates of UPS and FedEx. For example, if DHL eCommerce charged a fuel surcharge for $.03 per pound and FedEx Ground Economy charged 5% of the cost of the shipment. For a 5lb package that cost $7 to ship using either service, the seller would pay $.15 (5 lbs X $.03 per lb) versus $.35 ($7.00 X 5%) in fuel surcharges for DHL eCommerce and FedEx Ground Economy, respectively.

DIM: DHL eCommerce treats DIM weight slightly differently than UPS and FedEx as they do not charge a DIM factor for packages less than one cubic foot. This can make a significant pricing difference for lite weight packages in larger packaging.

Tracking: Since 2003, DHL eCommerce has used USPS exclusively for their last mile delivery and they inject their packages into USPS distribution centers. Unlike UPS and FedEx, DHL eCommerce has less control of their packages in regards to delivery speeds and reliability since they don’t use their own delivery trucks or employees for any of their last mile deliveries.

DHL eCommerce International

DHL’s various small parcel offerings focus on cross-border consistency and customs expertise, particularly across North America and into international corridors.

DHL Small Parcel (and its Parcel Plus Expedited variant) often outperforms domestic carriers on international ground routes because DHL controls customs processes, provides strong visibility, and offers predictable transit times for cross-border shipments.

Within strictly domestic US shipping lanes, DHL’s footprint is smaller than USPS, UPS, or FedEx, so it’s best chosen when cross-border speed, duty handling, and international tracking are priorities.

UPS Surepost, FedEx Ground Economy (formerly Smartpost), and DHL eCommerce: Infographic

If you are looking for a 3PL to help understanding which shipping options are best for you, or require logistics support we’d love to hear from you. You can read DCL’s list of services to learn more, or check out the many companies we work with to ensure great logistics support. Send us a note to connect about how we can help your company grow.

Tags: Freight, Shipping Carrier Updates